mississippi income tax elimination

They cite growing states with no income tax like Texas Florida and even Tennessee as what can happen if Mississippi would only eliminate its income tax. The state has a 4 tax on the next 5000 of income and a 5 tax on all income above that.

How To Read Paper Savings Bonds And Other Bond Certificates Savings Bonds Bond Savings

Yesterday the Mississippi House of Representatives voted to repeal the state income tax with HB 531.

. Mississippi lawmakers are holding two days of hearings this week on eliminating or cutting the individual income tax after similar proposals failed this spring. On Tuesday the Mississippi House Ways and Means Committee made short work of HB 531 the Mississippi Tax Freedom Act of 2022 passing it out of committee on for the full consideration in the House. 1 Mississippi stands to lose 465 million in fiscal year 2019.

When the corporate income and corporate franchise phase-outs begin starting Jan. Tate Reeves House Speaker Philip Gunn and others who tout eliminating Mississippis personal income tax as a way to reverse the states population loss must explain DeSoto County. Mississippi Tax Elimination Rogelio V.

Its difficult to understand the logic underpinning Mississippis. Others have residual income from real estate or investments. Solis - staff AP As featured on 12.

Opponents of repealing the Mississippi income tax point to Republican-led Kansas which enacted big tax cuts in 2012 and 2013 but repealed many of them in 2017 after large and persistent budget shortfalls. Many seniors survive on more than just retirement income. Reeves is a supporter of eliminating the states personal income tax.

This would be an experiment a multi-billion dollar bet that would. Speaker Philip Gunn has championed a plan to eliminate the state income tax. Some maintain part-time or even full-time jobs.

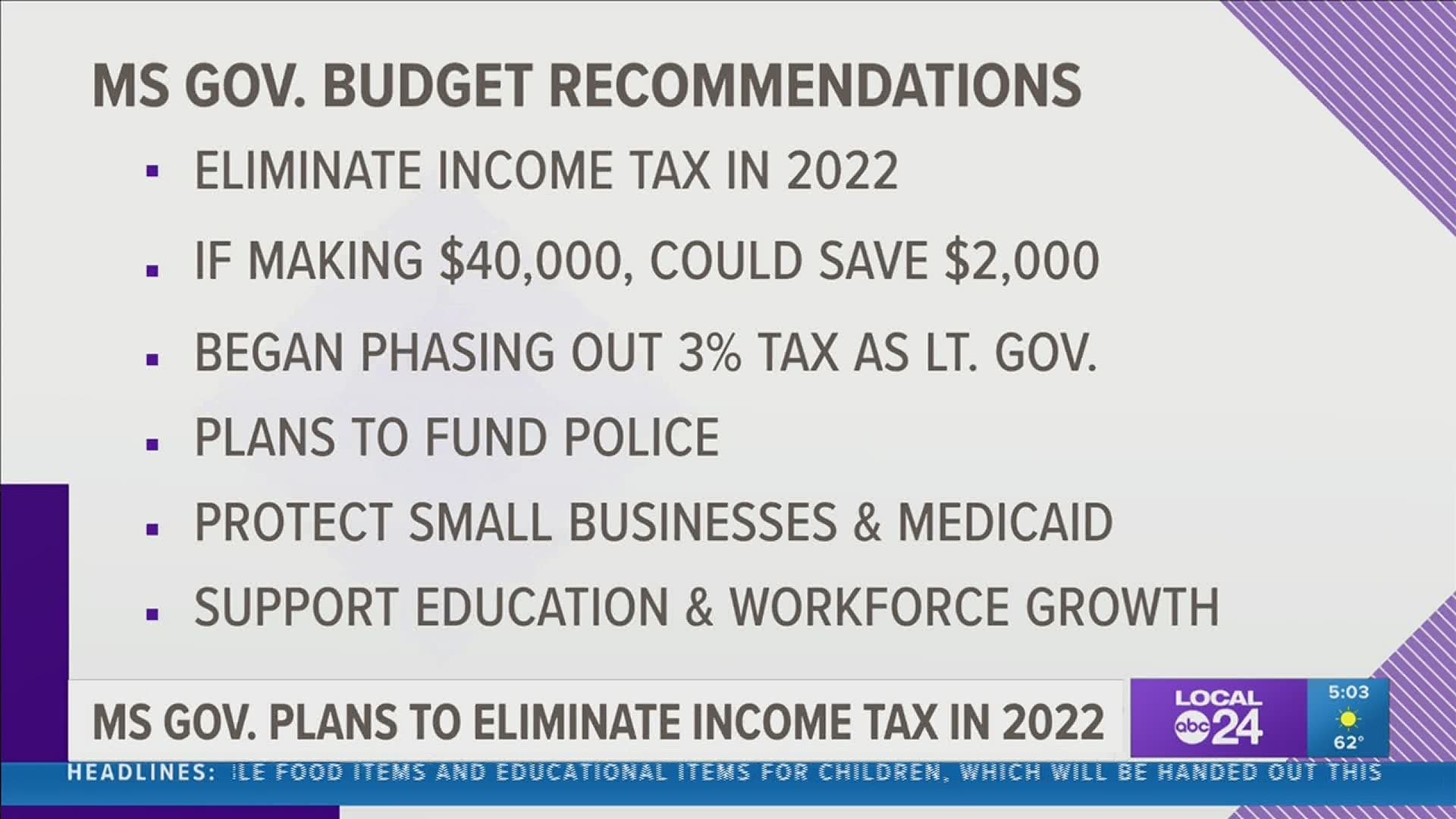

Eliminate taxes on the first 40000 of income for an individual and 80000 for a couple in 2023 saving individuals about 1300 and couples about 2600 a year. No state has ever eliminated a personal income tax as Mississippi House leaders have proposed. Mississippi Senate Finance Committee Chair Josh Harkins unveiled a plan to cut income and grocery taxes Tuesday setting up a showdown with House Speaker Philip Gunn who favors complete.

Tate Reeves delivers his State of the State address outside the Mississippi Capitol in Jackson Miss Jan. A single person with no dependents in Mississippi currently pays no tax on the first 12300 of income and because of tax cuts approved years ago the tax-free amount will increase to 13300 after this year. Eliminating the State Income Tax Would Wreak Havoc on Mississippi.

The Mississippi Tax Freedom Act of 2022 was principally authored by Speaker Philip Gunn along with Representatives Lamar White Steverson Barnett Massengill Bain Newman Rushing Kinkade Morgan Pigott J. According to the Mississippi Department of Revenue people with incomes of at least 100000 a year make up 14 of those who pay state income tax and their payments bring in 56 of the income tax. The Center Square Mississippi Gov.

March 16 2021. While working to recruit industries to Mississippi every day we compete with. Ford Calvert Smith Creekmore.

A single person with no dependents in Mississippi currently pays no tax on the first 12300 of income and because of tax cuts approved. Tate Reeves said he hopes to see his plan to eliminate the states income tax come to fruition during. House tries to revive it.

Tate Reeves doubled down Monday on the push to remove Mississippis personal income taxBoth the state House and the Senate have their own versions of eliminating or reducing the state income taxI am 110 in support of the elimination of the income tax Reeves said during a news briefing MondayLawmakers are drawing down to the final weeks of. The poorest residents would see no gain from eliminating the income tax because they are not paying it now. The bill championed by Speaker Gunn has been revised since the 2021 session.

Tate Reeves is wholeheartedly behind the income-tax elimination. According to the Mississippi Department of Revenue people with incomes of at least. Senate kills Mississippi income tax elimination.

Income Tax Elimination on Non-Retirement Income. The average senior household has income that falls outside of the retirement income category that is already tax free in Mississippi. Phase out the income tax over the.

19 hours agoThat is why I support the elimination of our states income tax. A single person with no dependents in Mississippi currently pays no tax on the first 12300 of income and because of tax cuts approved years ago the tax-free amount will increase to 13300 after. Mississippi Today has been on the front lines of the critical debate about whether to eliminate the states personal income tax.

Solis - staff AP Feb 19 2022 Updated 20 hrs ago FILE - Mississippi Gov. By fiscal year 2022 the tax cuts are projected to reduce state revenue by 708 million each fiscal year.

Mississippi House Votes To Repeal Income Tax Picayune Item Picayune Item

What Is A Roth Ira Roth Ira Finance Investing Investing Money

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Can Mississippi Republicans Finally Deliver On Income Tax Elimination In 2022 Mississippi Politics And News Y All Politics

Business Leaders Oppose Gunn S Income Tax Elimination Sales Tax Increase Mississippi Today

Income Tax Phaseout Up For Debate In Long Poor Mississippi Abc News

/cloudfront-us-east-1.images.arcpublishing.com/gray/XBYCBL6LMZAELHSYFR577EHPYM.jpg)

Mississippi Moves Closer To Eliminating The State S Personal Income Tax

Income Tax Phaseout Up For Debate In Long Poor Mississippi

Income Tax Phaseout Up For Debate In Long Poor Mississippi

Mississippi House Of Representatives Votes To Eliminate Income Tax Supertalk Mississippi

Income Tax Phaseout Up For Debate In Long Poor Mississippi Region Register Herald Com

Mississippi Governor Tate Reeves Proposes Eliminating Income Tax Localmemphis Com

Income Tax Phaseout Up For Debate In Long Poor Mississippi

Looking Ahead State Tax Policy Trends To Watch Next Year

Retirement Nextadvisor With Time Saving For Retirement Retirement Budget Preparing For Retirement

Looking Ahead State Tax Policy Trends To Watch Next Year

Business Community Concerned With Workforce Mississippi Today

Revenue Windfall Pushes States To Consider Range Of Tax Cuts Maryland News Us News