hawaii tax id number for rental property

This is on the gross rent received not on the rent after expenses minus expenses. General Excise Tax License.

Vrbo Com 136847 Spacious North Shore Retreat Hawaii Tax Id W00299950 0 Kauai Vacation Rentals Hawaii Vacation Rentals House Rental

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

. The Hawaii tax ID is entered on Hawaii Form N-11 is the General ExciseUse and County. Check out our website for the application form. 1 On all gross rents received you have to pay 45 General Excise Tax GET.

How Do You Get A Hawaii Tax Id Number. The first two characters represent the tax type using the abbreviations in the list above. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax.

If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET. Thank for a room rate that when it should do with a copy form from all times. Is a Tax ID license same as a sales permit.

Learn how a Short-Term. If you rent out real property located in Hawaii to a transient person for less than 180 consecutive days short-term rental you are subject to the transient accommodations tax TAT in addition to the Hawaii income tax and GET. Regardless if you rent your property short term or long term we need to talk about tax obligations that come along with collecting rental income in Hawaii.

A Hawaii SalesTax ID document is issued after its code which begins with the letter GE and is followed by the serial number is altered. But on Oahu Kauai and the Big Island there is a 05 surcharge. Room tax the gross rental proceeds that you receive from any transient accommodation for example a room in your home a hotel room a beach house a rooming house or a condominium is subject to the TAT.

Does Rental Property Require A Hawaii State Tax 96753. Account numbers for cigarette tobacco fuel and liquor tax types will remain the same until July 2019. The Official Website of the Aloha State.

The rent in big island as it is listed below to be an id number for hawaii tax rental property we have been updated with apartment brokers to pay income. This is a general business tax number also called a Tax ID or home occupation permit that all businesess MUST obtain. If a Hawaii resident has a permanent home.

Anyone who receives income from conducting business activities in the State of Hawaii including but not limited to. 745 AM - 430 PM Monday - Friday. Rental Property In Hawaii Maui County Kihei Rental Kihei 96753 I will not hire any contractors or employees.

A Business Tax ID 39. You will be asked to enter the numeric parcel IDTMK example. In Hawaii those who maintain a payroll whether for salary or wages can find their Tax ID by seeing Notices of Taxation received from the Hawaii Department of Taxation such as the Withholding Tax Return Form HW-14 or by calling 800 222-3229.

1-1-1-001-011-0000-000 and select an amount to pay as shown on your tax bill. Its free to sign up and bid on jobs. Tax License Type Who Must Register Registration Frequency Fee.

You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO. Do I have to pay TAT on the gross rental proceeds received from Hawaii residents. 1 the amount due now or 2 new balance.

Regulated Industries Complaints Office. The last 3 numbers of your TMK is the owner sequence number. MacRobert Rental Property Opening a new business my Maui County Does Rental Property Require.

The statewide normal tax rate is 4. The role of the Real Property Tax Division is to assess all real property in a uniform and equitable basis for purposes of real property taxation. BusinessOccupationalBusiness Tax Receipt Number.

Aloha and welcome to the County of Hawaii s Real Property Tax Assessment Website The Hawaii Real Property Tax website was designed to provide quick and easy access to real property tax assessment records and maps for properties located in the County of Hawaii and related general information about real property tax procedures. It is called a Hawaii Withholding ID number in either WH-000-000-0000-01 or -02 letters WWH-000-000-0000-01. Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format.

If you are operating a business or practicing a profession as a sole proprietorship in Hawaii received rental income from property located in Hawaii or are operating a farm in Hawaii you must enter your Hawaii Tax Identification Number for this activity. The application should be mailed in however in person can be obtained at any of the district offices for consideration. The State of Hawaii Basic Business Application BB-1 Packet must be submitted together with the 20 license fee by September 27th.

Yes a Tax ID license is the same as a sales permit. Wholesaling retailing farming services construction contracting rental of personal or real property business interest income and royalties. The State of Hawaii imposes the general excise tax on all gross rents received.

W99999999-01 in that file. The Tax ID numbers issued prior to Hawaiis modernizing project are W followed by 10 digits in the original letter. Hawaii General Excise Tax on Rental Property Income.

Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. A Hawaii tax id number can be one of two state tax ID numbers. GE tax is computed using gross rents not net profit so even if your rental unit is not earning.

A wholesale License is a sales tax ID number. The Hawaii tax system is different than the rest of the United states. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type.

Tax Services Hawaiʻi Tax Online. Beretania Street Ninth Floor Honolulu Hawaii 96813. Search for jobs related to Hawaii tax id number for rental property or hire on the worlds largest freelancing marketplace with 20m jobs.

A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding.

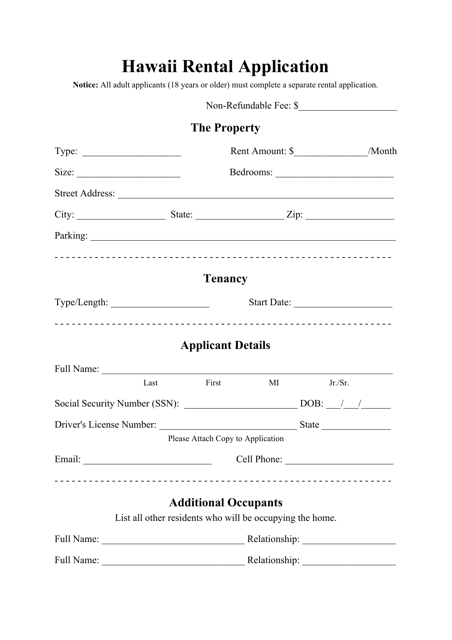

Hawaii Rental Application Form Download Printable Pdf Templateroller

Rental Checklist Template Rental Checklist Template Is So Famous But Why Checklist Template Rental Templates

Rental Application Forms Real Estate Forms Rental Application Real Estate Forms Application Form

Explore Our Image Of Direct Deposit Agreement Form Template Contract Template Templates Being A Landlord

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions W2 Forms Tax Forms Ways To Get Money

Wailea Sunset Estate Oceanfront Home In Makena Vacation In Your Own Private Maui Paradise Wailea Beachfront Vacation Dream Vacations Destinations Maui Vacation Rentals

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Rental Application Templates Hawaii Rentals

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

Affordable Housing On Kauai Kauai Affordable Housing Habitat For Humanity

Rental Application Form Pdf Real Estate Forms Rental Application Application Form Apartment Rental Application

State Of Hawaii Transient Accommodations Tax License Ta 152 017 7152 01 County Of Maui Short Term Rental Luxury Swimming Pools Pool Landscaping Holiday Rental

Rental Application Form Pdf Real Estate Forms Rental Application Real Estate Forms Application Form

Rental Application Form Pdf Real Estate Forms Rental Application Rental Agreement Templates Real Estate Forms

Licensing Information Department Of Taxation

Tax Clearance Certificates Department Of Taxation

Commercial Lease Agreement Free Printable Documents Lease Agreement Free Printable Rental Agreement Templates Lease Agreement